About Us

Konwave AG is a Swiss provider of active investment solutions in structurally attractive themes focused on gold mining and transition metals equities.

For more than 25 years we have set benchmarks as a Swiss specialist and European market leader in active mining funds. Our funds stand out thanks to broadly diversified portfolios with an attractive blend of small- and mid-cap mining equities. Through our pioneering approach to sustainability and ESG we create forward-looking investment opportunities. Repeatedly recognised for top performance – including the prestigious Lipper Fund Award – we count among the leading addresses for successful mining investments.

Konwave AG is a Swiss provider of active investment solutions in structurally attractive themes focused on gold mining and transition metals equities.

We concentrate on the most compelling value-creation phases of the mining industry. We are supported by geologists and engineers who lay the foundation for successful stock selection in the small-cap segment. Our experienced team, the broadly based top-down/bottom-up

investment process, the ideally sized assets under management in an international comparison, and the long-standing collaboration with leading geologists have underpinned our track record since 1999. We are a reliable, long-term oriented and successful partner for our clients.

We are a well-coordinated team with many years of experience in asset management, mining and sustainability matters. Consistency, dependability and a high level of expertise characterise our work and form the basis of our success.

We are supported by a highly qualified technical team of geologists and engineers who possess extensive expertise and decades of practical experience in mining. This collective knowledge enables us to pinpoint opportunities, assess risks

with confidence and develop sustainable strategies.

Together we combine commercial, technical and sustainability-driven know-how – for robust decisions, lasting value and a successful future.

The investment funds we manage or advise have an above-average exposure to the most attractive value-creation phases of the mining industry.

Our long-standing, successful collaboration with highly experienced top geologists (with a combined professional experience of over 100 years) provides the foundation for stock selection in small-cap equities. Thanks to our geologists and engineers, who are exceptionally well connected in Canada and Australia (the main markets for gold equities), as well as close cooperation with investment boutiques in the mining space, we enjoy excellent access to compelling financings.

The ideal size of our assets under management compared with international peers allows us – unlike the very large competitors – to operate more nimbly in the small-cap segment. Each responsible portfolio manager brings more than 15 years of experience in macro and gold mining. Further details on the broadly based top-down and bottom-up investment process follow below.

Since 1999 we have been managing assets in mining equities, continually refining and improving the investment process. Modifications to the process have always been driven by a review of achieved investment results and detailed analysis of the performance drivers in the market.

The process is founded on a multi-stage, systematic approach split into top-down and bottom-up components. Within the top-down approach for the gold equity funds we determine the allocation to each region, the segments (major producers, intermediate producers, small producers, explorers and developers), the split between equities and physical metals (ETFs, ETCs) and the metal exposure of the producers including physical holdings (gold, silver, PGMs and other metals). The bottom-up approach covers the selection and weighting of individual securities.

We aim to generate added value for our clients versus the defined investment objective by investing where, in our view, risk-adjusted success prospects are highest. All investment specialists work in the same location, ensuring rapid, efficient information flow and leading to decisions that positively influence your investment outcomes.

Within a dedicated team approach, all decision-relevant information is processed. Investment decisions and performance responsibility are clearly defined and lie with each fund’s portfolio managers.

In a first step we consolidate our current insights from fundamental, technical and market-psychology elements (behavioural finance) to define the most likely market scenario (return expectation), incorporating risk scenarios. On this basis we set the optimal investment level from a risk-return perspective.

In fundamental analysis we assess the global economic cycle, drawing on the research of leading securities houses. In addition, for many years we have used a successful suite of leading-indicator models. As a further factor we examine the outlook and current level of the well-known Citigroup Economic Surprise Indices.

Technical analysis focuses on relative trend indicators, momentum indicators, intermarket analysis and Elliott Wave analysis.

At the behavioural finance level we primarily utilise sentiment indicators, money-flow data, put/call ratio analyses and market surveys.

For stock selection and managing over- and underweights at security level we apply a comprehensive analytical process. The goal is to identify the securities with the greatest return potential while avoiding those with the highest downside risk.

The funds we advise hold an above-average exposure to the most attractive value-creation phases of the mining industry. We have been supported for many years by top geologists with a combined experience of over 100 years, giving us excellent access to attractive financings in Canada and Australia. The broadly based investment process rests on four analyses, with every security assessed and ranked against these factors.

In gold equities the quality of mining projects, management teams and geopolitical risk are particularly decisive. We draw on our own site visits (around 100 per year), an expert team of geologists (on a mandate basis), bespoke reports from selected leading securities houses and our in-house analysis. Within the fundamental analysis, valuation is critical. We undertake project-based discounted cash-flow assessments, factoring in country risk (geopolitical) and valuation relative to growth potential (production, earnings and resources).

Technical analysis emphasises relative trend models, comparing each company’s return with the underlying index in a medium-term context.

At the quantitative level we have, for many years, worked with a highly successful US investment boutique that analyses around 5,000 securities worldwide on a return/risk basis.

Through our industry contacts we gauge the potential pool of additional buyers or sellers in each company. Shares that are excessively “loved” and widely held (market darlings) typically carry an above-average risk of disappointment, whereas stocks with very high short-selling ratios and low penetration by professional investors usually offer above-average upside potential.

Sustainability is central to the long-term success of a mining company. We therefore rely on independent ESG data from MSCI ESG and integrate these metrics into our investment process. Social licence, together with environmental and employee protection, is especially important to us.

Learn more about our sustainability approach here.

Happy Birthday!

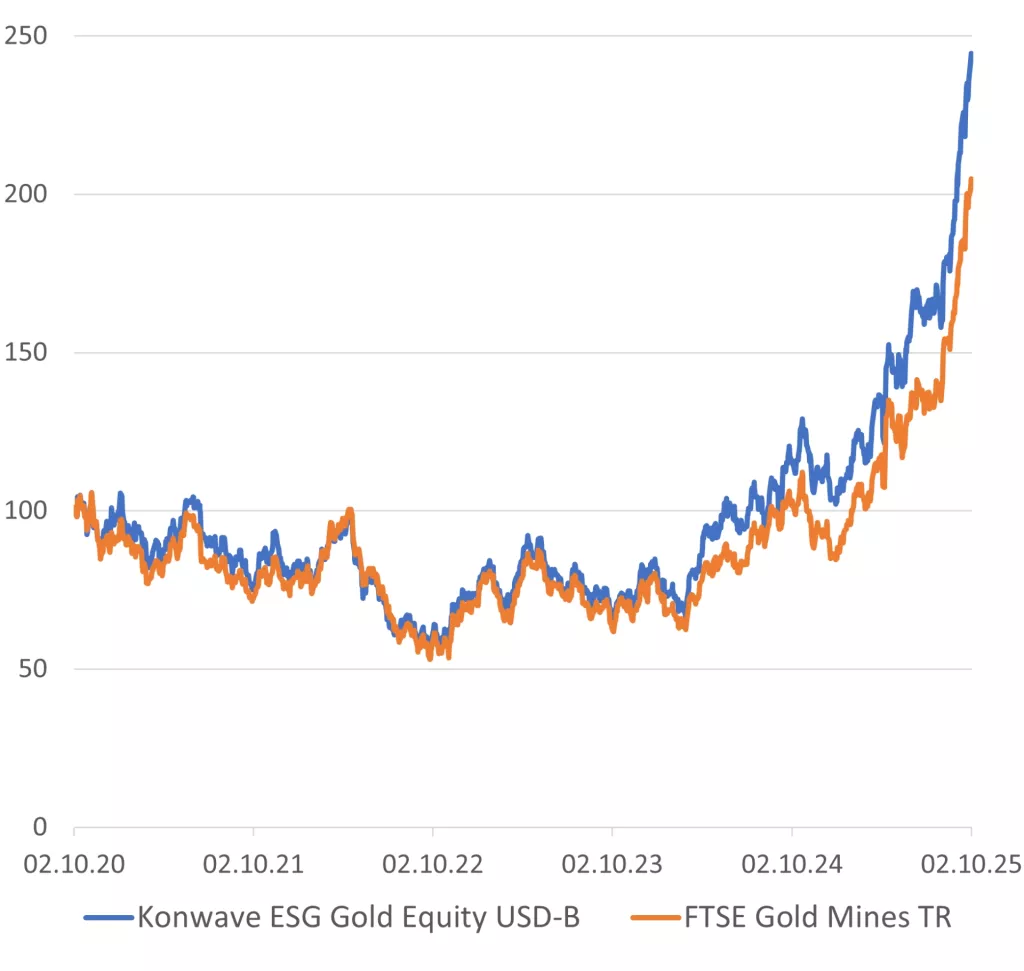

Today, the Konwave ESG Gold Equity Fund celebrates its 5th birthday. Since its launch on October 2, 2020, the fund has enjoyed an impressive track record, posting a total return of 143.6%—significantly outperforming the benchmark, which returned 104.1% over the same period.

Even the large gold mining ETFs were unable to keep pace: the GDX has gained 97.8% since 2020, while the GDXJ has gained 80.1%. The Konwave Gold Equity Fund’s consistent outperformance underscores the quality of its active management and successful stock selection.

This strong performance is one of the reasons why the fund was awarded the prestigious Lipper Fund Award this year. A wonderful milestone – and a birthday present that impressively confirms the successful work of the last five years.

Here’s to many more successful years!

The Konwave ESG Gold Equity Fund has been named the best gold mining fund over three years in Switzerland and Europe this year. In the five-year category, the Konwave Gold Equity Fund was recognised in Switzerland. In addition, the NESTOR Gold Fund, also managed by Konwave AG, won the LSEG Lipper Fund Award in Europe over five years.

The LSEG Lipper Fund Awards are among the most prestigious distinctions in the fund industry. They honour fund managers who deliver consistently strong risk-adjusted returns over extended periods. The award for the Konwave ESG Gold Equity Fund is particularly noteworthy, demonstrating that ESG-compliant gold mining funds can also generate above-average performance. This recognition underscores Konwave AG’s leading position in precious metals equity funds and sustainability.

The Konwave Gold Equity Fund has won the 2024 Lipper Fund Award – Best Fund over 5 Years – Equity Sector Gold & Precious Metals.

We are delighted to announce that our company has received the renowned Lipper Fund Award (Europe, Switzerland, Germany, Austria) for a five-year period.

The annual Lipper Fund Awards honour funds that deliver superior returns compared with their competitors. This accolade is a testament to the quality of our portfolio management team, which is dedicated to identifying the most promising gold mining equities.

Even more important than the award is the added value we have generated for our clients in recent years – a marked outperformance versus both active and passive competitors.

Today Konwave AG hosted a webinar on “Gold price breakout from a multi-year consolidation and the start of a structural bull market.” This insightful presentation analysed current developments in the gold market and discussed the long-term outlook for investors.

You can rewatch the webinar at your leisure here: